Description

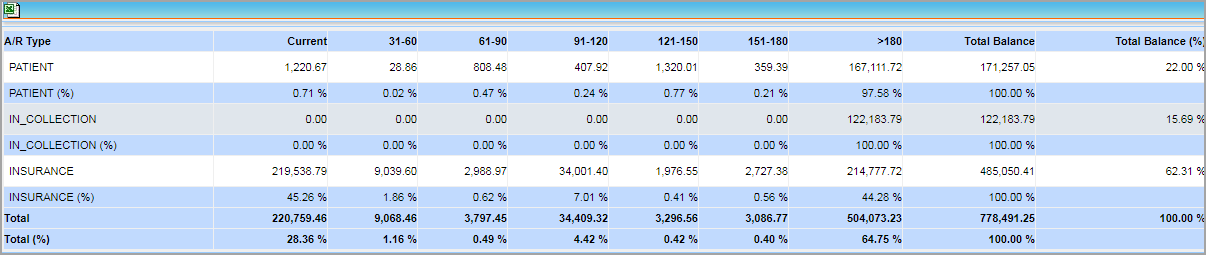

D6 report is an aging summary report displaying a breakup of the A/R for patient, insurance, and collections with aging buckets and percentages.

D6 report indicates how long insurance claims and patient balances have been outstanding and are represented as a percentage over 180 days. It is represented as amount in dollars as well as a percentage.

Significance

1. The A/R aging represents the outstanding amounts owed to your practice by insurance plans, patients/guarantor, and other entities.

2. The A/R Aging Summary Report provides the following information.

- It shows how long invoices have been outstanding (aging) from payers, patients/ guarantors, and other entities.

- It shows who owes money (patient or payer).

- It shows how old the balance is (30-60-90-120-150-180+ days). It is sorted into columns such as: Current, 1-30 days past due, 31-60 days past due, 61-90 days past due, 91-120 days past due, and 121-150 days past due,151-180 days past due and 180+ days past due.

Search Filters of D6 report

| Field | Description |

| Legal Entity | To filter by Billing entity |

| Provider | To filter by providers |

D6 Search screen

Sample D6 report

Possible Outputs of D6 Report