PracticeSuite uses an accounting (transaction) date concept for financial reconciliation. All transactions in the system are captured along with an accounting date, and this field is generally editable unless the entered accounting date falls within a closed-month period.

Closing a month, hence, prevents the editing of transactions that fall in the closed period. This action maintains the sanctity of the reconciled reports for the closed months.

I Month End Close

Month End Close process involves two steps: (i) setting the status of the required month to close, and (ii) running the reconciliation report. These are explained below.

1. Financial Year Open/Close.

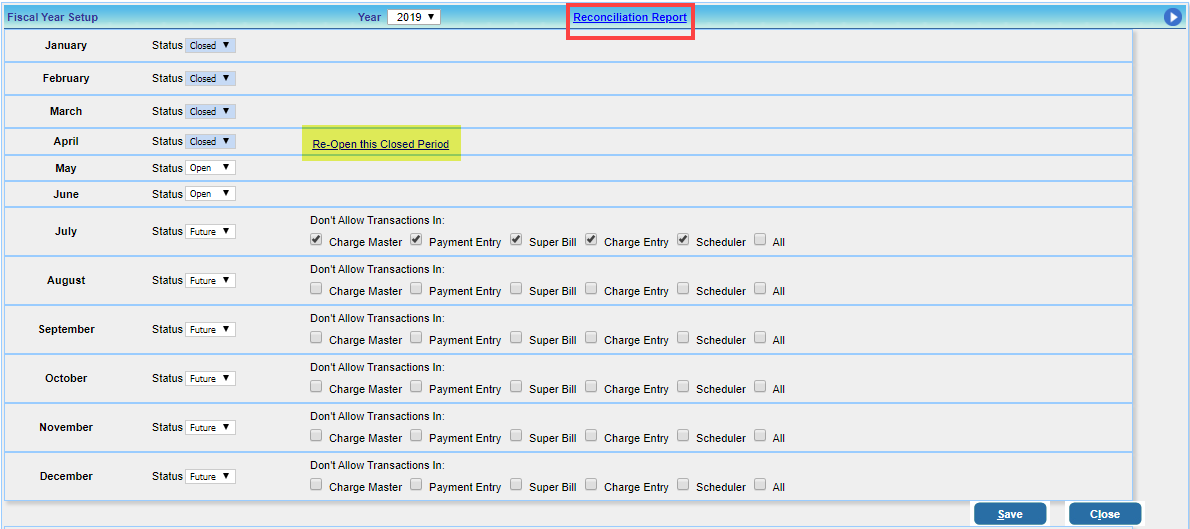

Expand the Advanced Setup menu to access the Fiscal Year Setup screen (see Image 1). All past and future months for the financial year are listed on this screen, along with the statuses (open, closed, or future). New months can be closed if only all the previous months are closed. The statuses and their descriptions are provided below.

a. Open: All transactions are allowed for the month.

b. Closed: No transactions are allowed with the month’s accounting date if the month is Closed.

c. Future: Any future months show this status. All transactions are allowed with this status.

2. Running the Reconciliation Report.

Click on the Reconciliation Report link (highlighted in red in Image 1) and run the report for the closed month. The reconciliation report is a spreadsheet and has every transaction – charges, payments, schedules, etc.—made for the accounting date range in separate worksheets. To learn more, click here.

II Reopen a Closed Month

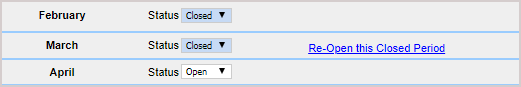

Only a user with an administrator role or privileges can reopen a closed month. Image 2 shows a part of the Open-Close screen as seen by an admin.

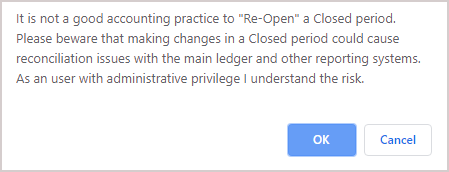

To re-open a closed month, the user can click on the link ![]() (seen in Image 2 and highlighted in yellow in Image 1). The system will prompt for confirmation from the user, as shown in Image 3.

(seen in Image 2 and highlighted in yellow in Image 1). The system will prompt for confirmation from the user, as shown in Image 3.

Note: To track status changes easily, an activity log is provided on the screen to record the date, time, and user who changed the open/close status.