Mass Write-Off Screen

The practice can efficiently write off payments for multiple patients at once using the mass write-off screen, eliminating the need to process each write-off individually from the posting screen.

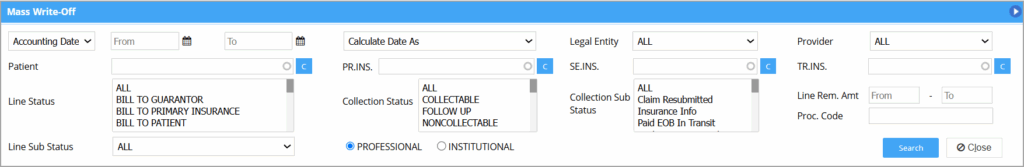

Search Screen of Mass Write-Off Screen

Search Filters

| Field | Description |

| Date | Select either Accounting date or DOS from the drop-down and provide the range |

| Legal Entity | To show results only for a specific legal entity |

| Provider | To view results for a specific provider |

| Patient | To view results for a specific patient |

| PR.INS | Primary insurance |

| SE.INS | Secondary insurance |

| TR.INS | Tertiary insurance |

| Line Status | Multi-select option provided (Use CTRL key). Select HOLD status to exclusively select HOLD lines. |

| Line Substatus | Multiselect option provided (Use CTRL key) |

| Collection Status | Collection Mngr Status |

| Collection SubStatus | Collection Mngr Substatus |

| Proc Code | Procedure codes can be searched with modifiers also. |

| Line Rem. Amt | Provide a range for the remaining amount in the line |

| PROFESSIONAL/INSTITUTIONAL | Choose between the two |

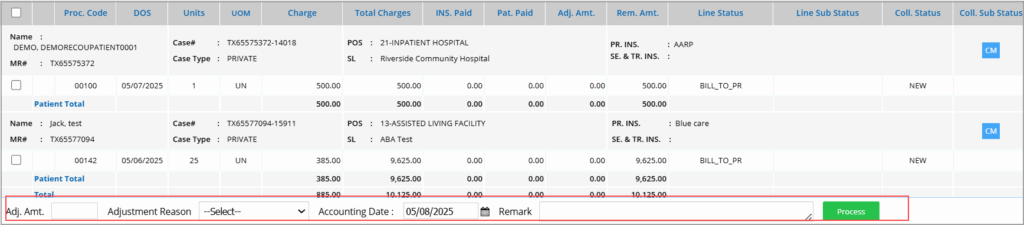

Charge Display on the Mass Write-Off Screen

Note: The screen has a mouse hover for several fields, such as Case#, DOS, POS, SL, and insurance. In the case of insurance, primary, secondary, and tertiary insurance names are listed, and on mouse hover, the subscriber number of the patient for the insurance will be shown.

Select the required charges for write-off using the checkboxes provided on the left side and provide the values in the write-off fields provided at the bottom of the screen (explained in the table below).

| Field | Description |

| Adj. Amt. | Enter amount to write off the specified amount from the selected lines. The line status remains unchanged if an amount remains in the line after the write-off.

If no amount is given in this field, the entire amount in the line is written off, and line status will be WO_CLOSE |

| Adjustment Reason | Select an adjustment reason from the drop-down |

| Accounting Date | Acct. Date for mass write-off is defaulted to the current date; however, it can be changed to another date |

| Remark | Provide remarks if any |

Now click on the Process button to complete the Write-Off.